OUR SERVICES

Your vision deserves the right financing. Whether you're launching a business, acquiring property, or scaling your real estate investments, Essencap offers tailored loan solutions to bring your goals to life. From Business Working Capital Loans up to $150,000 with a 10-year term to Fix & Flip, Bridge, and Commercial Real Estate Investment Loans, we provide the flexibility and support you need.

Be bold, be authentic—your unique story drives your success. With Essencap’s diverse financing options, including One-to-Four Family Investment Property, Construction, and Business Acquisition Loans, stand out in a competitive market and turn your ideas into reality.

-

• Full 30 year terms, no balloons

• Streamlined qualification process emphasizing property level cash flow

• No tax returns required; No DTI calculations

• Up to 80% LTVs

• Simple, haggle-free pricing you can depend on

• Protect your identity and other assets by borrowing in a corporate entity

For pre-approval fill out the intake form online.

Detail Instruction

Fill out and sign the attached application.

Copy of Driver License and Passport

For the non-US citizen, please provide a green card.

Foreign nationals please provide a travel visa.

For two of the past five years, do you own any other investment property? Will require an questionnaire.

Is the subject property under management by a Property Management Company.

If self-manage, can you provide 24-month deposit prove with cancel check or bank statement, or Schedule E

Please note, it does not impact our ability to lend. There is a Loan to Value adjustment.

Is the subject property under management by a Property Management Company.

Will provide Management Questionnaire

For purchase, provide a purchase contract

For refinancing, provide the most recent bank statement

Will need a payoff letter at the time of closing.

If the property is part of the HOA association

Confirm the number of units sold, % of ownership

Require HOA by-law

Please provide the most recent HOA statement

Most recent real estate tax statement

Then we need

appraisal,

entity document,

insurance,

2 month bank statement to close (to show down payment, 9 month liquidity)

-

Fix and flip loan is designed to provide leverage for an investment property that needs works. The plan for our borrower is to fix the property and sell it. And most importantly you keep all of the profit. We make the financing easy, we typically close on the funding transaction in under 10 to 15 days. Our loan is to provide funding for the property purchase plus funding for the renovation. So you don't have to worry about investment capital.

Essencap is the direct lender in the fix and flip. The funding process simple and strength forward.

1) Contact us. Best for us to understand your project scope. Keep in mind we are here to serve you.

2) Document Collection & Review. We conduct credit & background check. We gather Real Estate Experience & Personal Financial Statement. We order the Appraisal Report, the final value is based on your scope of work.

3) Underwriting and title process.

4) Funding

Detail Instruction

1) For pre-approval please fill out the intake form.

2) For process we need the application.

3) Copy of ID -Driver License/Passport

For the non-US citizen, please provide a green card

Foreign nationals please provide a travel visa.

4) Please disclose the borrower's credit condition such as credit score and condition

borrower is require to e-sign e-consent and credit authorization

5) If this is a purchase, please provide a purchase contract.

Refinance, provide the most recent mortgage statement.

6) Review of borrower experience, please fill out the below track record link.

7) Line items of the renovation budget. Per attached budget

8) Borrower assessment of current property value and as completed value.

9) We request third party report such as appraisal, feasibility study, title, and insurance.

10) We fund!

-

Commercial real estate is a property used for business purposes. Most often, commercial real estate is leased to tenants to conduct business, or the landlord is conduct business in collecting rental income. This category of real estate ranges from an apartment building to a shopping center or hotel.

Commercial properties may refer to:

retail buildings

office buildings

warehouses

industrial buildings

apartment buildings

hotel and motel

student housing

one to four family investment property

“mixed use” buildings, where the property may have a mix, such as retail, office and apartments.

Investing in commercial real estate can be rewarding. Investors can make money on a monthly basis by collecting the rental payment but also through property appreciation when they sell.

Investors can invest directly in the property as investments and become landlords with active management. People best suited for direct investment in commercial real estate are those who either have a considerable amount of knowledge about the industry or who can employ firms who do. Commercial properties are a high-risk, high-reward real estate investment.

Detail Instruction

Essencap offers commercial real estate loan at a competitive rate/program. We can provide solution in a variety of situations.

To start the process, please follow the below instruction and provide the information.

1) For investor greater than 20% ownership,

Please fill out the attached 1003 application (personal financial statement)

3 years of personal tax return

If the borrower owns other business.

Please provide 3 year tax returns on the business.

Year to date financial on the business

Debt schedule per attached, please includes all credit card, mortgage, car loan

Please provide most recent statement to support the debt schedule.

2) 3-month bank statement

3) Please provide investment summary

4) Rental income per each unit, and lease term

Annual expense (Tax, Insurance, Utility, Management Fee)

5) Purchase Contract

6) Copy of Leases

7) Please disclose credit condition for any judgement, late payment and if you know you estimate credit score.

Any question please contact us at fax/phone 888-269-1033

-

Essencap offers construction loans for owner business occupant, apartment and condo construction projects. Please find our checklist requirement below.

1) For investor greater than 20% ownership,

Please fill out the attached 1003 application.

3 years of tax return (both personal and business (if the borrower own any other business)

2) Debt schedule per attached

3) Please provide a project summary

Budget

Land acquisition cost

The hard cost of material

All legal, architecture, and labor cost.

Down Payment Amount

A brief explanation of the timeline

4) Description of the project,

# of the unit, price point, permit status…etc.

5) Market Study

Rental rate – need projected rental roll

Sale Price – need projected sale price

Comps

6) Builder / Investor resume

7) An estimate of the borrower's credit score. Any credit condition that we need to aware of.

8) Any recent appraisal /environment report

Tele/Fax: 888-269-1033 wecare@essencap.com

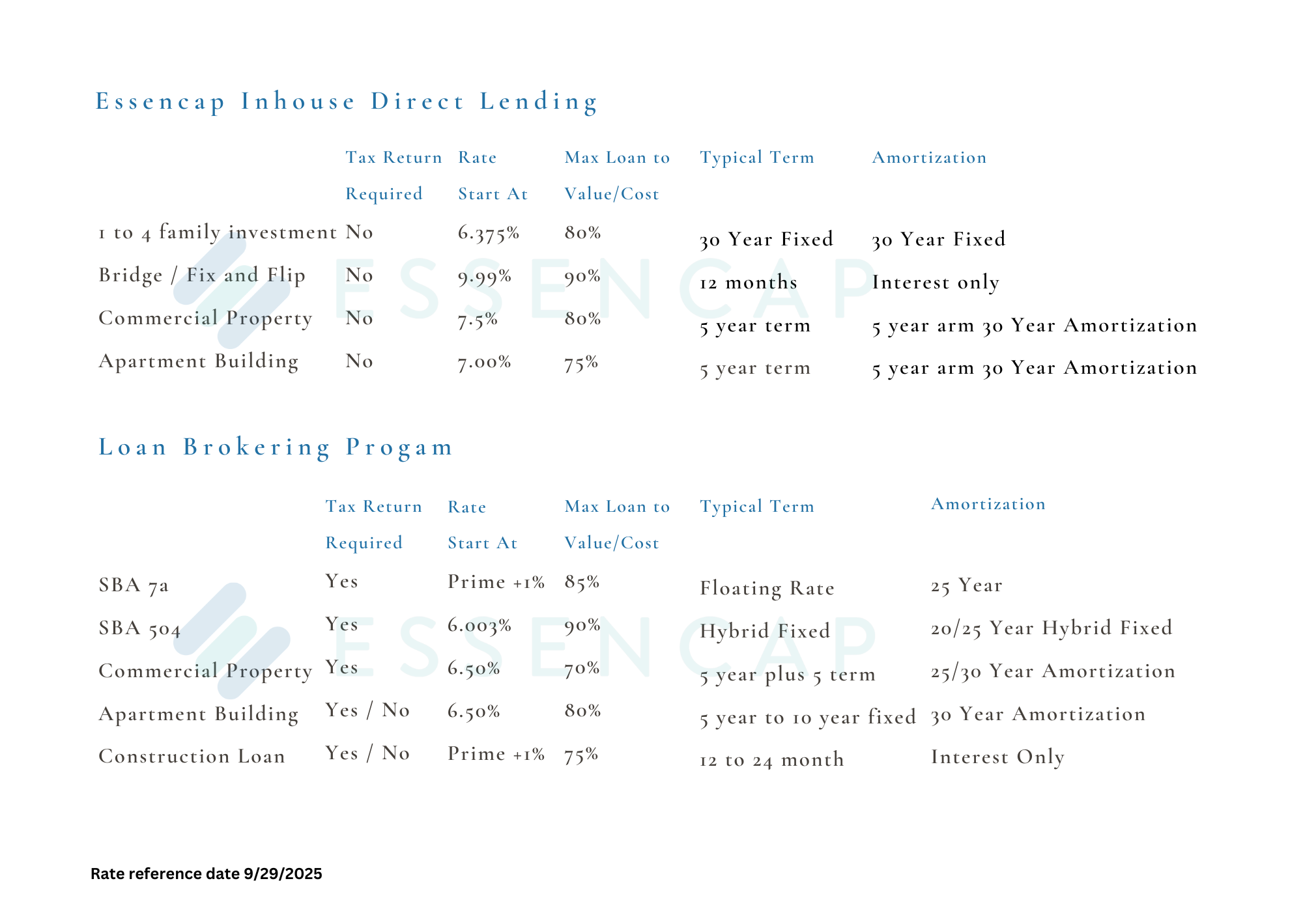

OUR RATES

**This is not a commitment to lend. All offers of credit are subject to due diligence, underwriting and approval. Not all borrowers will qualify and not all borrowers that qualify will receive the lowest rate or best terms. Actual rates and terms depend on a variety of factors and restrictions may apply. Essencap Funding LLC reserves the right to amend rates and guidelines without notice.

The interest rate provided is subject to change without prior notice and not all applicants will qualify for a loan. Approval and final terms, including interest rate, loan amount, and repayment period, are subject to credit criteria, income verification, and other factors. The Annual Percentage Rate (APR) may differ from advertised rates and includes certain costs and fees. A hard credit inquiry may be required, potentially affecting your credit score. Additional fees, such as origination fees or closing costs, may apply. Prepayment penalties may exist; please refer to the loan agreement for details. This disclosure is for informational purposes only and does not constitute a commitment to lend. All loans are subject to credit approval and underwriting. The lender reserves the right to change terms and conditions without notice. Please carefully review all loan documents before signing and contact our customer service department with any questions.

CONTACT US

Interested in working together? Fill out the information and we will be in touch shortly. We can not wait to hear from you!